- News

- India News

- Rs100 in Goa & Rs305 in Karnataka, excise duty difference defeats spirit of '1 nation, 1 tax'

Trending

Rs100 in Goa & Rs305 in Karnataka, excise duty difference defeats spirit of '1 nation, 1 tax'

Alcohol prices in India vary significantly across states due to differing excise duties and taxes, with Goa having the lowest levies. This disparity undermines the 'one nation, one tax' principle, encouraging bootlegging and revenue loss for high-tax states. Industry bodies advocate for tax rationalization to promote sustainable revenue growth and discourage excessive consumption, but finance ministers are hesitant to relinquish taxation powers.

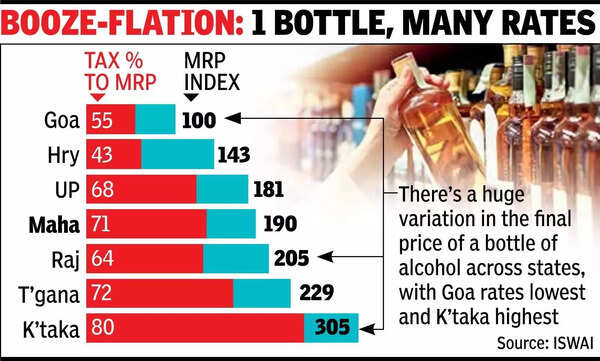

NEW DELHI: A bottle of alcohol that costs Rs 100 in Goa will set you back by Rs 305 in neighbouring Karnataka, Rs 229 in Telangana and Rs 205 in Rajasthan.

The massive price variation is due to the different levels of excise duty and other taxes that states levy, with the trend of Goa having the lowest levies remaining unchanged. If anything, taxes in Goa have inched up compared to a few years ago. Goa levies the lowest excise of 55%, while the tax rises 80% in Karnataka, the highest in the country, according to data compiled by International Spirits & Wine Association of India.

As a result, a bottle of popular Black Label whisky costs Rs 3,310 a bottle in Delhi, Rs 4,200 in Mumbai and around Rs 5,200 in Karnataka.

The difference in duties defeats the 'one nation, one tax' principle, with finance ministers making no effort to correct the situation, amid calls from industry to rationalise taxes. It also results in states with higher taxes losing revenue to bootlegging.

FMs reluctant to give up taxation powers

For instance, individuals in Delhi often hop across to Haryana to purchase alcohol as is the case in Tamil Nadu, where many people purchase liquor from Puducherry.

With excise on liquor and VAT on petrol and diesel being the only major sources of revenue for states after the introduction of goods and services tax, finance ministers are reluctant to give up further taxation powers, especially in a season of freebies, when the tax is used to bridge the deficit.

"While we recognise that the states have to augment their revenues, there is a need to build a sustainable model which focuses on stability and allows consumers to uptrade through premiumisation. This can be achieved through tax rationalisation and creating a pricing ladder that allows consumers to uptrade, thereby building the ethos of drink less, drink better. We have seen revenue growth in the past in states like Maharashtra and Karnataka, where price correction through tax rationalisation has helped in incremental revenue growth that is sustainable," said Sanjit Padhi, CEO, ISWAI, the industry lobby representing global giants.

Rival body Confederation of Indian Alcoholic Beverage Industry too has said that different tax levels across states is a big challenge for the industry. "There is no cohesive strategy for the Indian alcoholic beverage industry. The industry needs a uniform taxation mechanism which will propel the growth," CIABC's Deepak Roy said recently.

End of Article

Follow Us On Social Media